Barometer Readings Webcasts

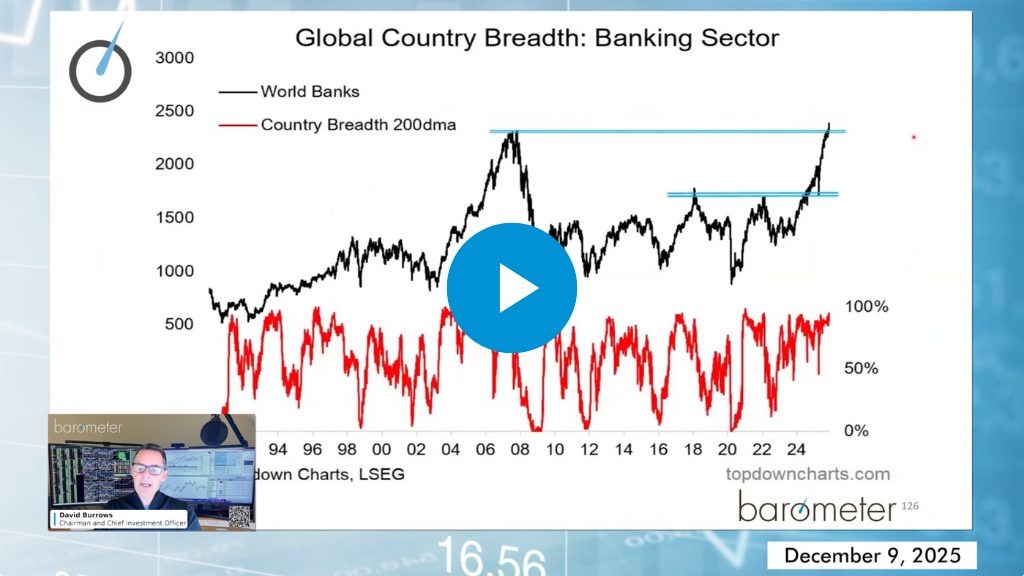

Markets continue to reflect an early-stage, broadening bull market, driven by expanding participation rather than narrow leadership. Headline indices such as the S&P 500 and NASDAQ 100 remain constructive, but equal-weight measures outperform, signaling that the average

In our first webcast of 2026, we review market conditions from a top down perspective and note improving breadth across global equities. The percentage of stocks in established uptrends has been rising, and the equally weighted S&P

Market leadership continues to broaden as economically sensitive sectors gain traction. Financials remain the strongest global leadership group, supported by improving breadth, stable credit conditions, and firm relative performance. Industrials, materials, transportation, and metals producers are also

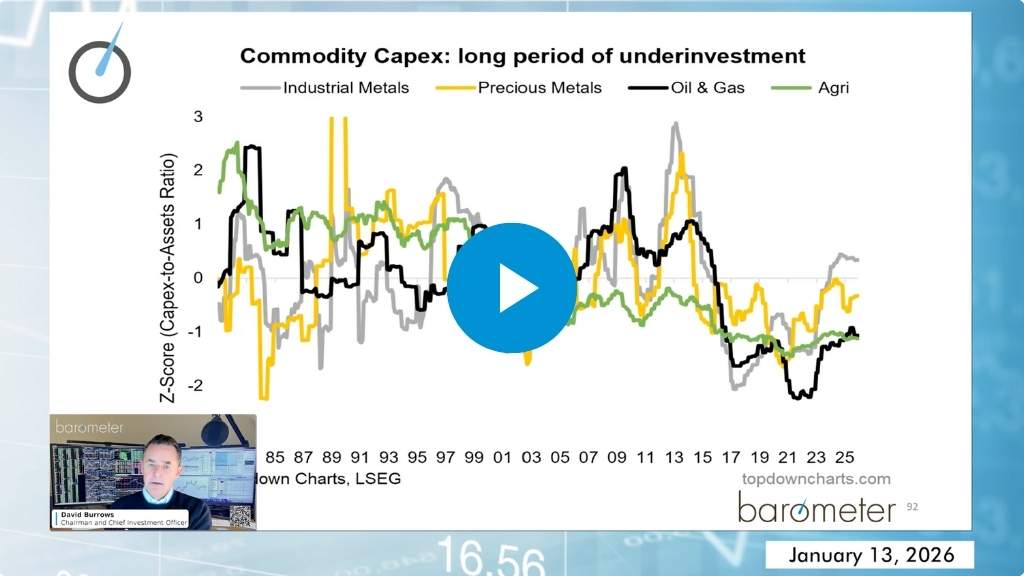

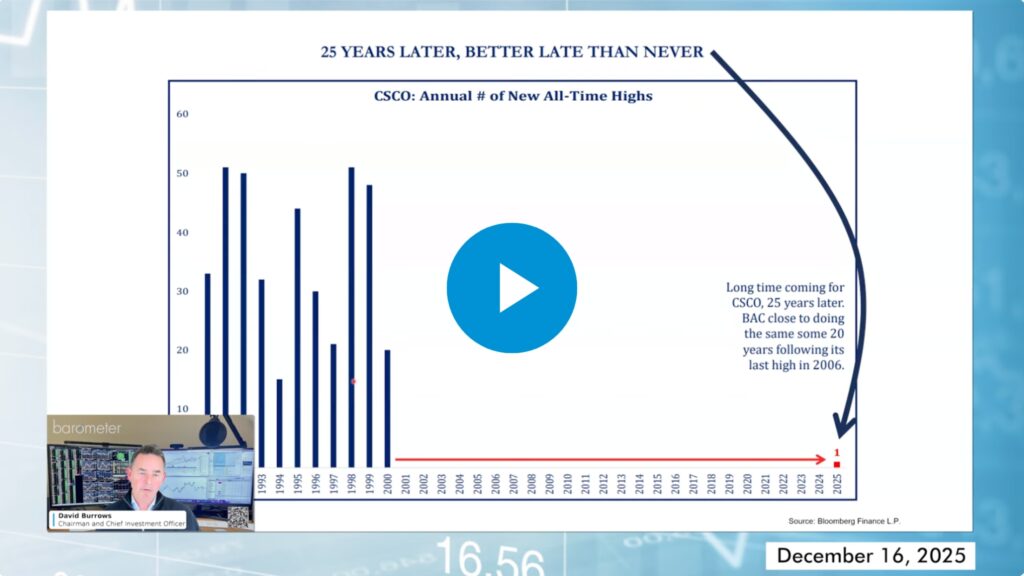

Market leadership is shifting toward financials, industrials, and materials as global breadth improves and inflation linked sectors gain strength. Precious metals, copper producers, and diversified miners are breaking out, supported by rising commodity prices and renewed liquidity.

👀Commodity stocks have room to 5-10x from here says @barometerca on @inthemoneypod

Watch the full episode: https://inthemoneypod.com/podcast/david-burrows/

"When we started to buy gold stocks 3 years ago, my young portfolio managers thought I had three heads." @barometerca said on @inthemoneypod

Watch the full episode now!

https://youtu.be/u8fCNRMLBK4?si=-rleeFpfXWLpdYZm