Big bounce higher in U.S. stocks ahead

If you’re turning cautious on the U.S. equity market you’re making a big mistake, according to David Burrows, President and Chief Investment Strategist at Barometer Capital Management. He sees the potential for a rise of 15 to 20 per cent in the U.S. market over the next nine to 12 months.

Diana Avigdor on trading in the “Treadmill Market”

Barometer’s Diana Avigdor, (VP, Portfolio Manager and Head of Trading discusses trading in a “treadmill market” on BNN.

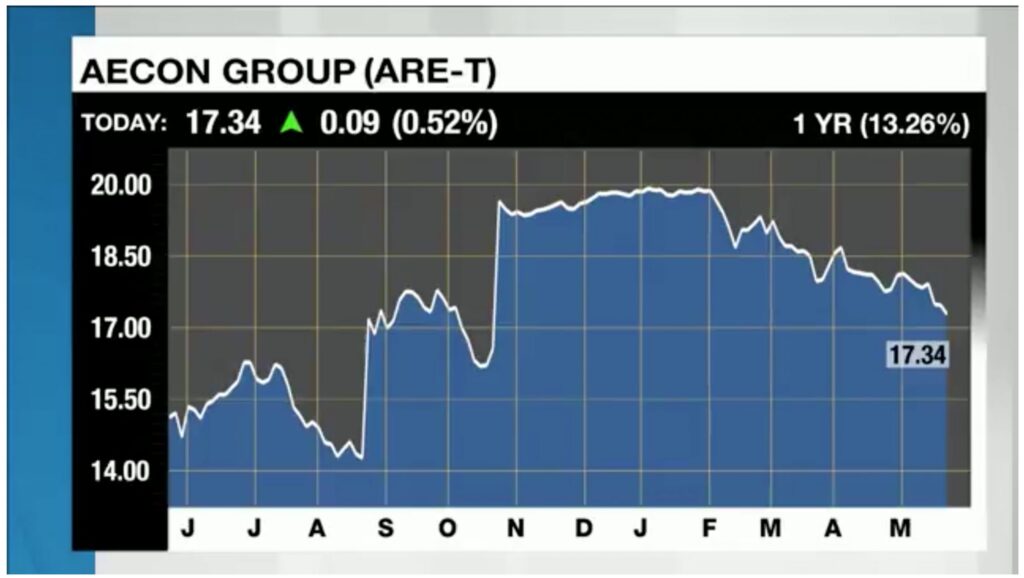

Did Canada Make the Right Call on Aecon?

David Burrows, President & Chief Investment Strategist, Barometer Capital Management Inc., shares his views on the Canadian Government blocking the takeover of Aecon.

Looking forward to a 5:30-6:30 pm EST spot on @bnn @marketcall. Taking viewer questions on North American large cap stocks.

Watch our most recent where we discuss our current market outlook and favoured sectors.

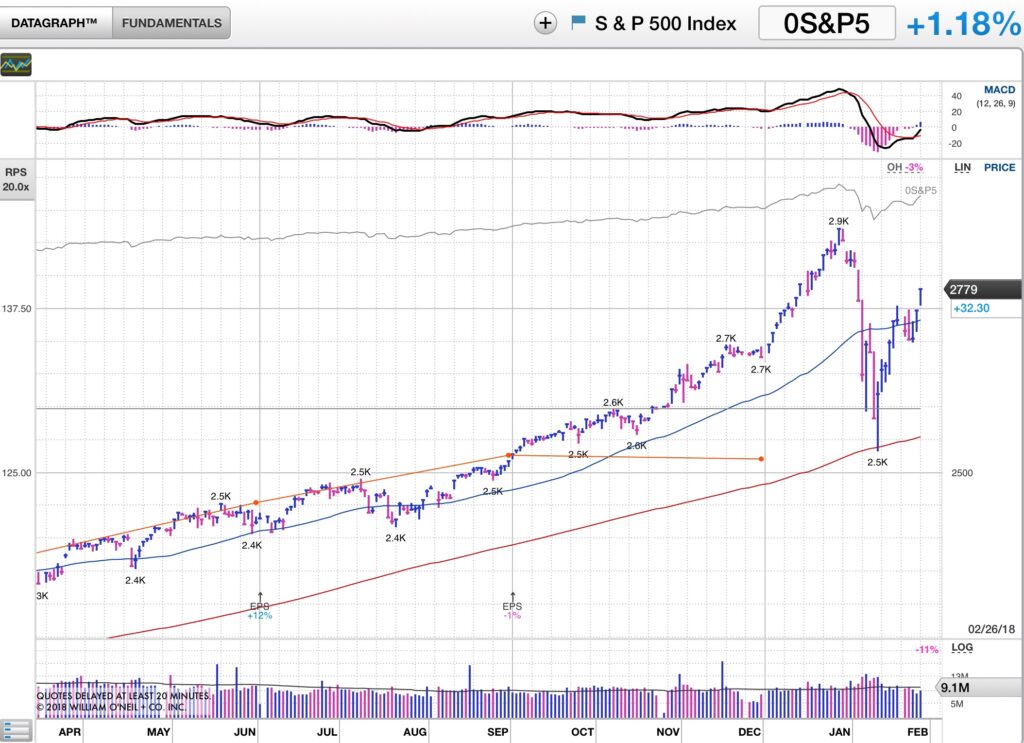

Equity Markets – Where To From Here? $SPY $QQQ $DIA $TLT

After a challenging 56 days for equity markets, what comes next may be a surprise. Watch this week’s short market positioning video

Equity Bull Market Life Expectancy – Bounce or Continuation? $SPY

Much has been made of the late January equity swoon and whether the bounce from the February 9 lows is sustainable. From the rising 200day moving average and the overnight S&P500 futures lows from the previous Monday night equities have rallied sharply. Since then, almost immediately, the four key short term breadth indicators Barometer uses […]

Correction, or something more sinister? $SPY $TLH

As of the close yesterday, the S&P500 has pulled back 7.8% from highs reached one week ago. Internally at Barometer the week before last we were discussing the extent that the market had become extended above its longer term moving averages and the possibility that we could see correction. As a potential trigger, we noted […]

Financials Re-Accelerate – 2 Minute Video

What can be gleaned from yesterdays move higher in financials as it relates to forward looking returns. $XLF $IAI $KBE $KCE