Broadening Strength: Resources Lead the Way

Energy and materials are fueling market gains, while disciplined sector positioning and strong dividend growth continue to drive portfolio outperformance against benchmarks. Key Points: Resource Producers Showing Leadership Energy and materials stocks, including Imperial Oil and Cameco, are in early stage bull markets with strong price action and rising relative strength. These companies are supported […]

Global Breakouts: Markets, Metals & Bitcoin Gain Ground

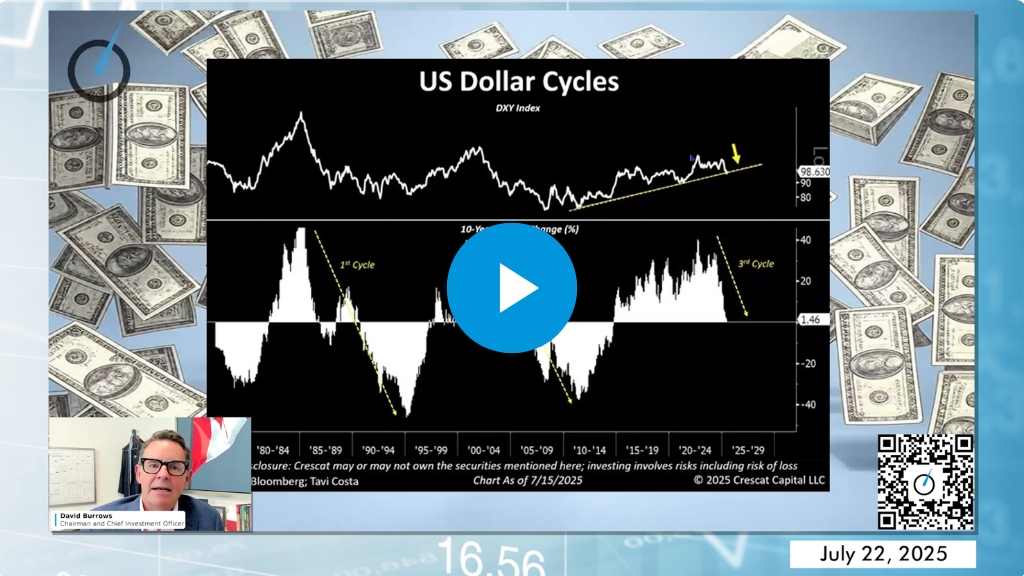

Global markets are regaining leadership, with breakouts in the Euro Stoxx 50, Nikkei 225, and TSX driving momentum. Barometer has boosted international equity exposure while leaning into strength in materials, metals, and Bitcoin as key macro hedges. Key Points: Global Markets Regain Leadership Global markets continue to lead, with breakouts in the Euro Stoxx 50, […]

Helping Future Investors Build Confidence and Knowledge

Invested & Connected: Bringing Financial Literacy to Life for the Next Generation Invested & Connected is based on a simple idea: if we give young people basic investing skills and tools, we can help them achieve financial success for life. These sessions provide students with more than just theory. They offer real-world insights and hands-on […]

Top Stock Picks: GE, Agnico Eagle, and Imperial Oil

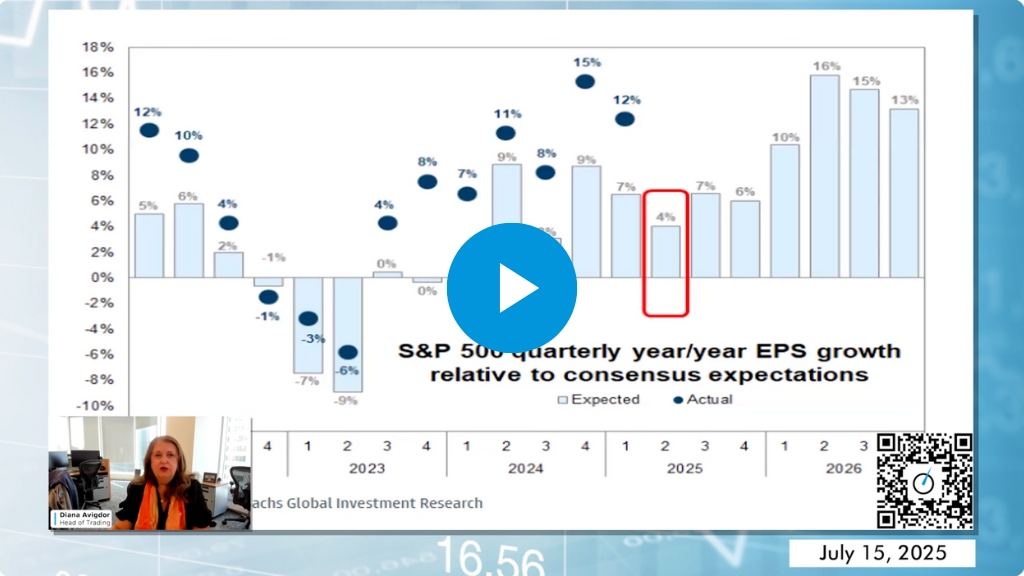

Strong Q2 Earnings from JP Morgan, Netflix, GE, and Nvidia in Focus

Markets remain steady as earnings from major sectors offer insight into current momentum and evolving market leadership. Key Points: Markets Flat as Investors Await Data and Earnings Equity markets were quiet last week, with small caps under-performing. Investors continue to favor large-cap multi-nationals benefiting from global exposure and a weaker U.S. dollar. Tariffs and Commodities […]

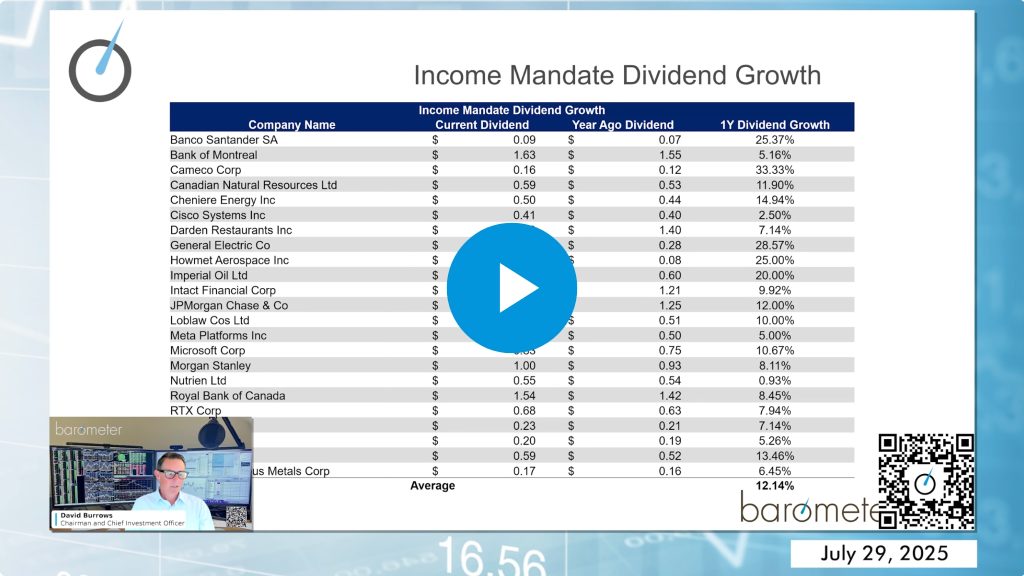

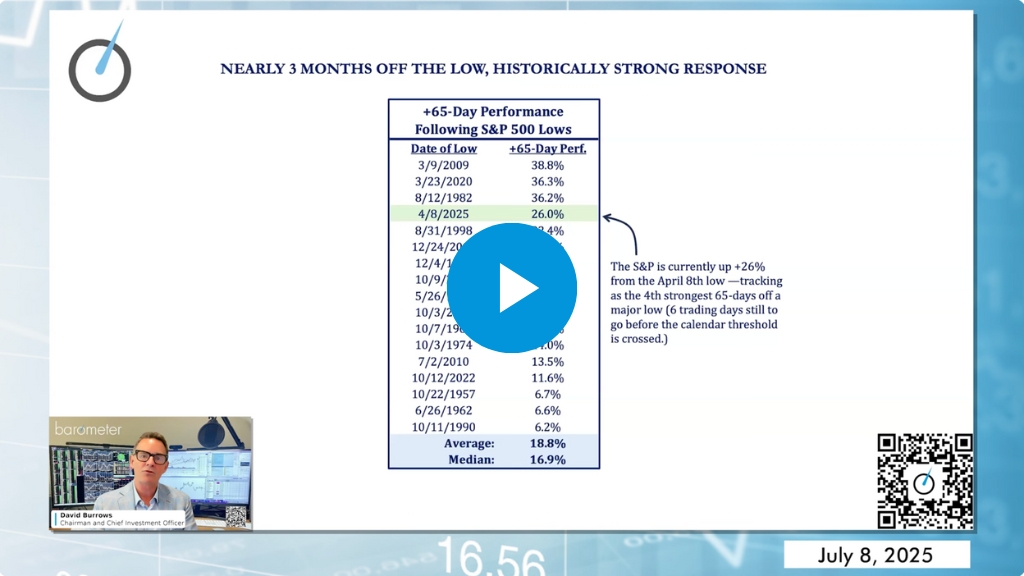

Global Market Breadth Strengthens as Dividend Growth and Cyclicals Outperform

Markets continue to show signs of underlying strength, with leadership emerging in select areas. Shifts in participation and capital flow suggest a changing tone beneath the surface. Key Points: Structural Bull Market Remains Intact Markets continue to behave like a long-term secular bull cycle—higher highs, higher lows, and strong breadth. The April pullback retested the […]

Navigating Market Uncertainty with a Cautious Strategy

This week, we provide an overview of current positioning across different mandates, highlighting a cautious and diversified approach. Allocations reflect a preference for safety and stability, with significant weight in liquid and inflation-sensitive assets. We also address broader market dynamics, potential policy shifts, and the outlook for global equities, emphasizing flexibility and readiness to adjust […]

Tactics, Positioning and Potential Outcomes

Financials Lead as Market Faces Risks and Sector Shifts

Market conditions have shown mixed performance across various sectors, with financials and energy maintaining strength, while technology and high-growth sectors face challenges. A cautious, defensive stance is being maintained with a significant cash allocation and flexibility for portfolio adjustments. Precious metals, especially gold, continue to perform well, and there are concerns over potential copper tariffs […]

Financials & Global Equities Driving Market Strength