Global stocks positioned for renewed leadership

Canadian banks, tech, and oil show market strength

Banks, gold, and global stocks power market gains

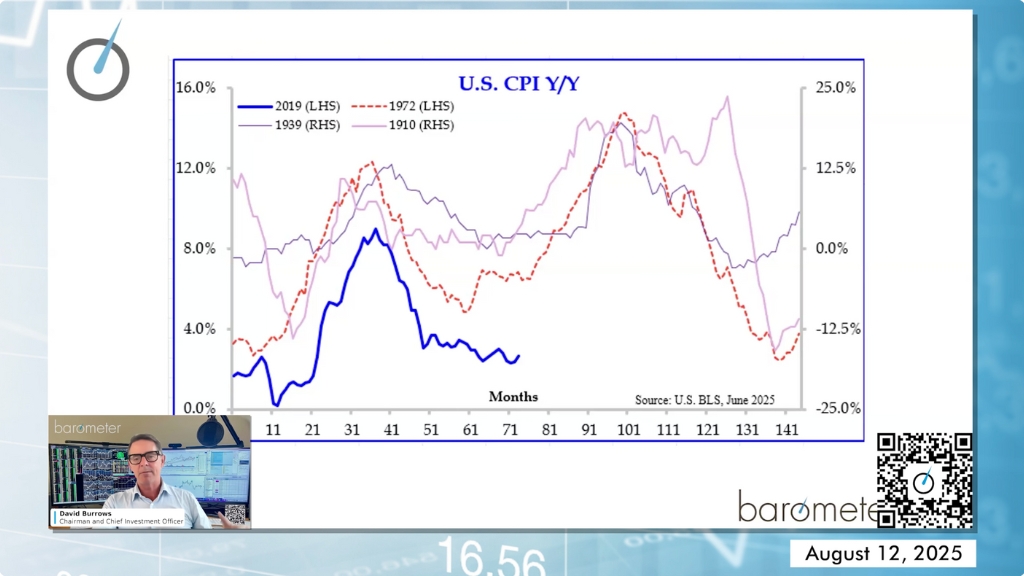

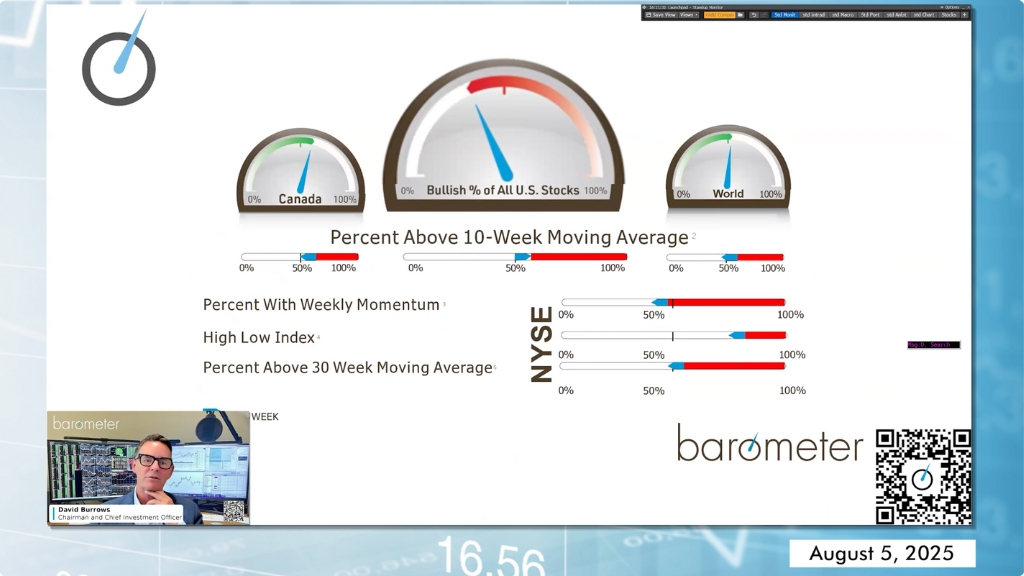

Are markets entering a period of seasonal weakness, or does expanding breadth and global leadership point to continued strength? In this week’s webcast, we examine Powell’s policy shift, rare 90/90 breadth signals, and leadership from banks, gold, and global equities that suggest the bull market case remains intact. Key Points: Structural Bull Market Intact The […]

Market leadership themes: MDA, Hudbay & global ETF

Is narrowing U.S. breadth a warning sign for investors?

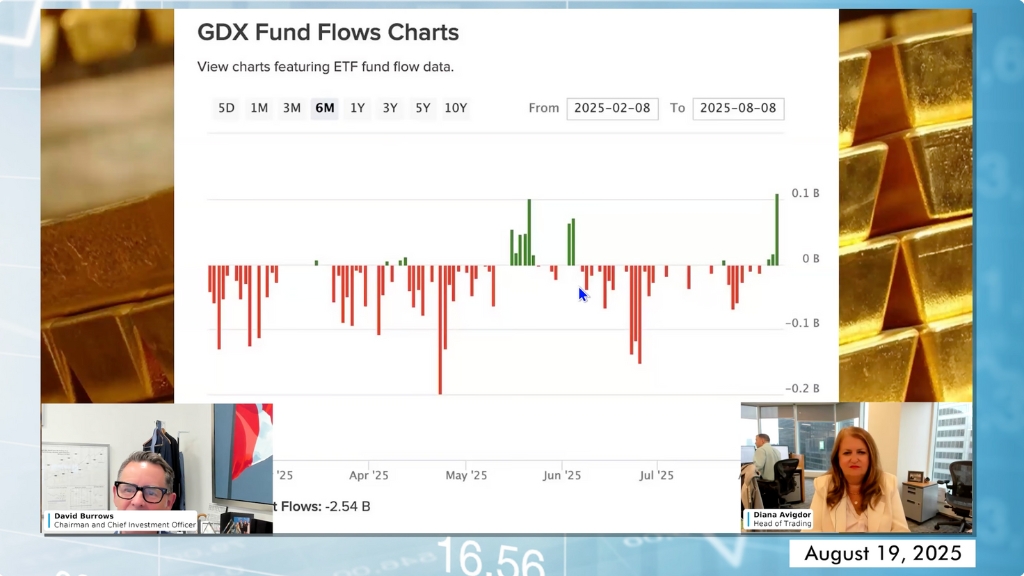

Markets present a nuanced picture. The S&P 500 (SPX) and NASDAQ (NDX) remain near highs, yet U.S. breadth continues to narrow. In contrast, global markets such as the Nikkei 225 (N225) and TOPIX are breaking out to multi-decade highs, with financials providing sustained leadership. Precious metals are also gaining traction, with gold (XAU), GDX, and […]

Global equities: will Japan and emerging markets lead next?

This week, we examine the broadening leadership in global equities and how we’re positioning portfolios to participate. Global markets are gaining momentum, with international leadership strengthening—Japan’s TOPIX 1500 up 37% year-to-date with broad participation (~82% above the 200-day moving average), Singapore up 28% year-to-date, and emerging markets breaking out on a softer USD. We are […]

TSX Tops Records as Tariff Risks Spark Caution

Shifts in breadth, emerging strength in leaders

Markets are shifting beneath the surface, with leadership concentrating in a select group of strong performers. Strategic adjustments this week reflect a focus on resilience while staying prepared for what’s next. Key Points: Breadth Narrowing, but Select Leadership Emerging From last week to this week, 6% of stocks moved from uptrend to downtrend, with a […]

Financials, Industrials, Energy Fuel Market Gains

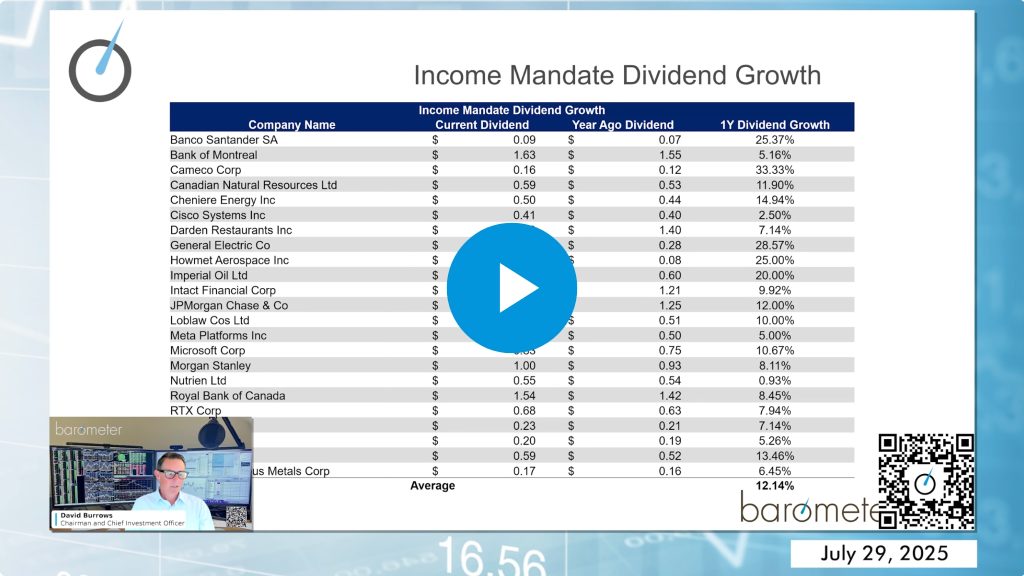

Broadening Strength: Resources Lead the Way

Energy and materials are fueling market gains, while disciplined sector positioning and strong dividend growth continue to drive portfolio outperformance against benchmarks. Key Points: Resource Producers Showing Leadership Energy and materials stocks, including Imperial Oil and Cameco, are in early stage bull markets with strong price action and rising relative strength. These companies are supported […]